Spring Cleaning Your Trading Strategy: 3 Steps to Refresh and Refocus for Q2 2025

March 5, 2025

It’s hard to believe we’re already staring down the end of Q1. For traders, this isn’t just another month; it’s a natural breakpoint to pause, reflect, and reset. The markets don’t care about New Year’s resolutions, but they do reward those who adapt. Think of spring as your chance to sweep away the cobwebs—old habits, sloppy trades, and cluttered thinking—and step into Q2 2025 with a lean, mean trading strategy. Using FX Bullsheet’s affordable, powerful tools, here’s how to do it in three actionable steps.

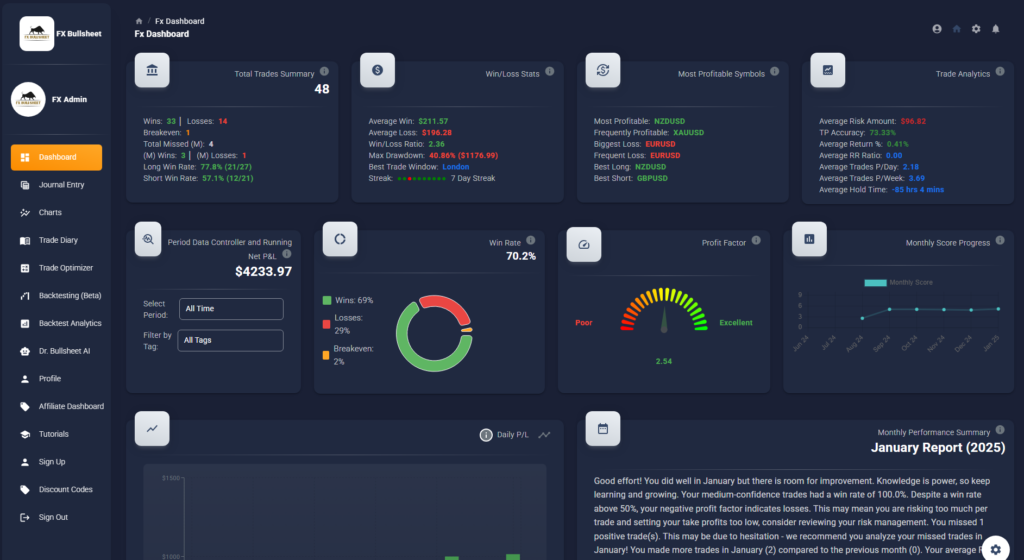

1. Declutter Your Trade Journal: Face the Mess Head-On

Every trader knows the feeling: a losing streak hits, and you’d rather scroll X than dig into why. But here’s the truth—your trade journal is your roadmap, and if it’s a mess, you’re driving blind. Log into FX Bullsheet and pull up your trade history from the past three months. Don’t just skim it—analyze it.

What to Look For:

- Are you piling into USD/JPY every time it spikes, only to get burned?

- Do your losses cluster on Fridays when you’re exhausted?

- Our AI-driven reporting cuts through the noise, spotlighting patterns with your personalized FX Bullsheet Score.

- One user, Jake from our community, found he was overtrading after 3 p.m. GMT—once he cut those trades, his win rate jumped 15%.

Action Step:

Tag every trade with a quick note (e.g., “Impulse entry” or “Solid setup”). Then, ditch the setups or habits that drag you down. Less clutter means sharper focus.

A clean journal isn’t just satisfying—it’s profitable. Spring’s the perfect time to stop hiding from your mistakes and start learning from them.

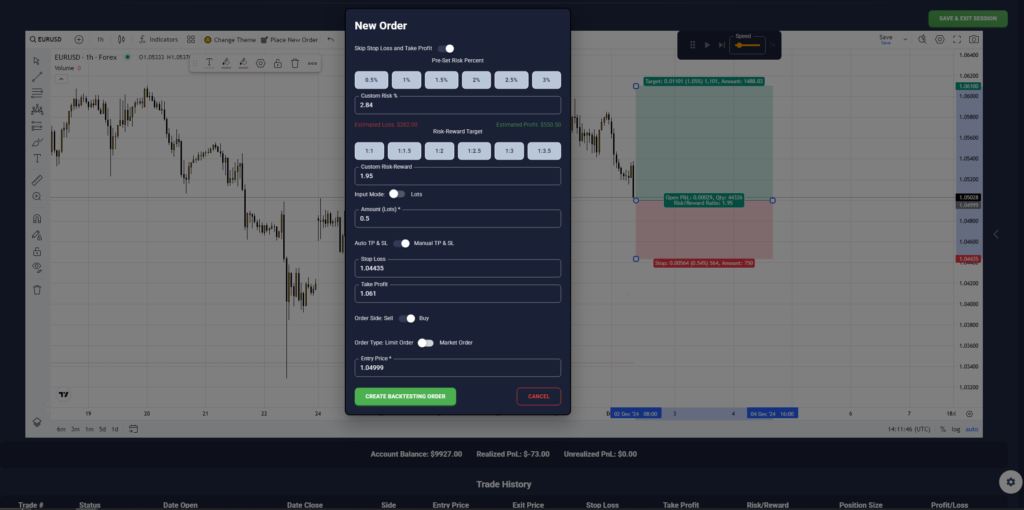

2. Dust Off Your Backtesting: Test Before You Trust

Markets aren’t static. That golden strategy from 2024—say, shorting EUR/USD on hawkish Fed rumors—might be rusting in 2025’s volatility. Assumptions age fast, and hope isn’t a plan. FX Bullsheet’s backtesting feature is your dustbuster here.

How to Do It:

- Pick your top strategy (maybe a moving average crossover or breakout play) and run it against the latest six months of data.

- Adjust one variable at a time—tighten your stop-loss from 50 pips to 30, or shift your entry trigger.

- Last month, Carla, a forex newbie in our community, backtested her scalping setup and found a 1:2 risk-reward ratio beat her old 1:1 by 20% in profit.

Why It Matters:

Economic shifts—like a surprise rate hike or a cooling jobs report—can flip the script on what works. March 2025 could bring anything from Fed pivots to geopolitical curveballs. Backtesting keeps you grounded in reality, not nostalgia.

Dust off those old ideas, tweak them, and step into Q2 with a strategy that’s battle-ready—not a relic.

3. Polish Your Risk Management: Protect Your Edge

Risk management isn’t sexy, but it’s the difference between traders who last and those who crash. Spring cleaning isn’t complete without shining up this cornerstone. FX Bullsheet’s risk calculator and portfolio visuals make it easy to see where you’re exposed—and fix it.

Get Specific:

- Check your average risk per trade. If it’s above 2% of your account, you’re flirting with disaster.

- One of our power users, Razz, used our charts to spot he was risking 5% on gold trades—fun until a $200 drop wiped out a month’s gains. He dialed it back to 1.5%, and his account’s been green ever since.

Set Rules:

- Write down your max daily loss (say, 3%) and stick to it.

- Use FX Bullsheet’s real-time tracking to enforce it—no more “one more trade” excuses.

- Visualize your risk across pairs or stocks. Are you too heavy on tech stocks or GBP crosses? Spread it out.

The Payoff:

Polished risk management turns chaos into control. You’ll sleep better knowing a single bad day won’t torch your account.

Q2 could bring wild swings—polish your risk now, and you’ll ride them, not fight them.

Why Now? The Q2 Pivot Point

March 2025 isn’t just spring—it’s a trading inflection point. Q1’s economic data (think jobs reports, inflation numbers) is in the books, and the Fed’s next moves are looming. Add in potential surprises—elections, supply chain shocks, or a crypto rally—and Q2 could redefine the game. Spring cleaning your strategy with FX Bullsheet doesn’t just tidy up—it positions you to profit when others are scrambling.

Take the Next Step

You don’t need a Wall Street budget to trade like a pro. For less than $16 a month, FX Bullsheet gives you AI insights, backtesting, and risk tools that the big dogs pay thousands for.

Ready to refresh your trading game? Sign up for a free trial at fxbullsheet.com and join a community of traders who’ve ditched the hype for real results.

Spring’s here—make it your season to shine.

No responses yet