Introduction

Every serious trader knows that keeping a journal is essential for long-term success. But let’s be honest—most trading journals fail. Whether it’s an Excel spreadsheet, a Notion template, or a basic note-taking app, traders often abandon their journals or fail to extract meaningful insights.

In this post, we’ll break down why most trading journals don’t work, the common mistakes traders make, and how FX Bullsheet provides the ultimate solution for trade tracking, in-depth analysis, and backtesting.

The Common Pitfalls of Traditional Trading Journals

1. Lack of Insights & Analytics

A trading journal isn’t just about recording trades; it’s about analysing them. Yet, many journals fail to provide:

- Performance metrics (Win rate, expectancy, drawdown, etc.)

- Trade tagging and filtering for strategy-specific insights.

- Risk-reward analysis to identify strengths and weaknesses.

- Equity curves & profitability charts

- AI Reports to analyse your trading performance and make suggestions.

Without these insights, traders struggle to identify patterns and improve their edge.

2. Notion & Excel Aren’t Built for Trading

Many traders attempt to use Notion, Excel, or Google Sheets as their journal. While they’re flexible, they aren’t purpose-built for trade journaling. Issues include:

- No built-in analytics – You’ll need to create complex formulas and charts yourself.

- Difficult to scale – As you trade more, these platforms become cluttered and unmanageable.

- Lack of backtesting features – Making it difficult to validate strategies based on historical data.

3. No AI or Smart Insights

A good journal should do more than store data—it should help you make better trading decisions. Traditional journals lack AI-powered insights that can:

- Spot patterns in your trading

- Provide data-driven recommendations

- Help optimize risk management

How FXBullsheet Solves These Problems

At FXBullsheet, we built the ultimate trading journal designed to solve all these common pitfalls. Here’s how:

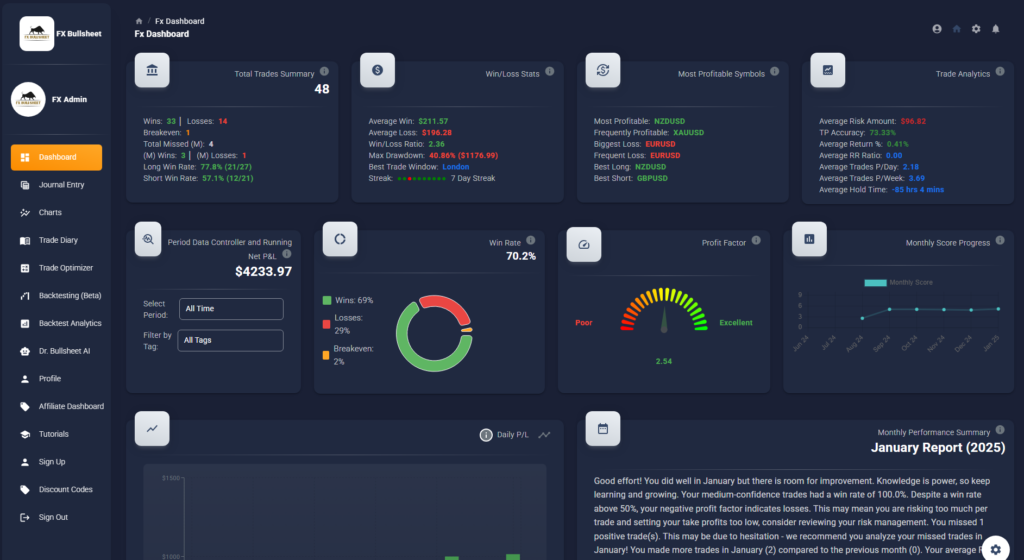

✅ Advanced Analytics & Performance Tracking

FXBullsheet provides deep insights into your trading performance, including:

- Win rate, expectancy, and risk-reward ratio

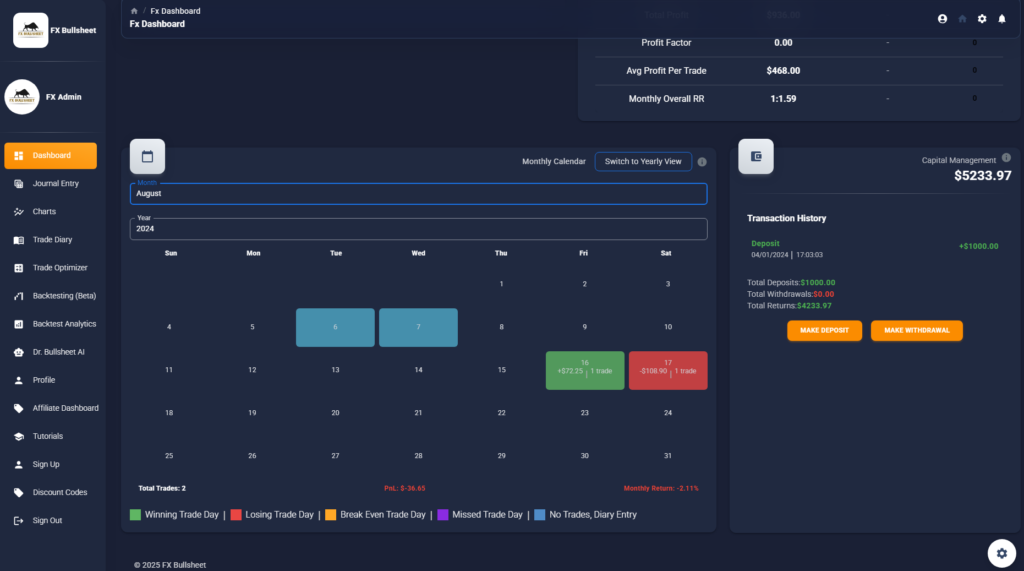

- Equity growth tracking & profitability curves

- Detailed trade tagging & filtering

✅ AI-Driven Insights & Trade Optimization

Our AI-powered system helps you identify your most profitable setups and avoid costly mistakes by analyzing your historical data and suggesting improvements.

✅ Customizable Trade Tagging & Strategy Filtering

Want to track how your breakout trades perform vs. your mean-reversion setups? FXBullsheet lets you tag and filter trades so you can analyze individual strategies with ease.

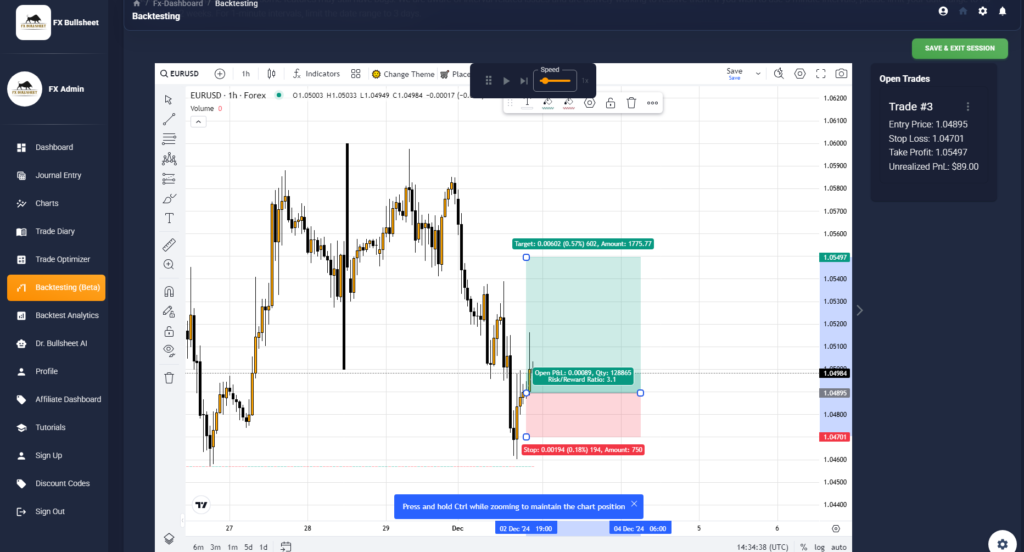

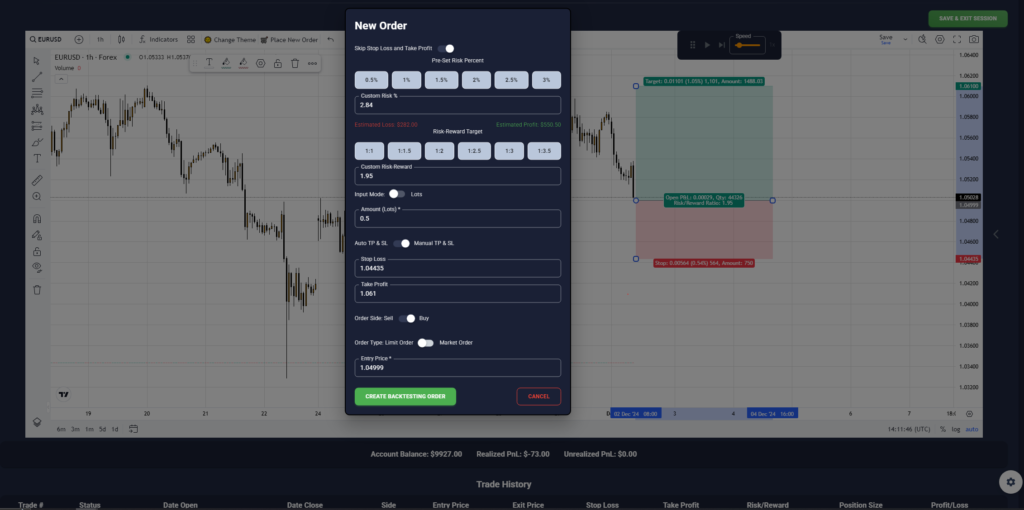

✅ Integrated Backtesting for Strategy Validation

FXBullsheet isn’t just a journal—it helps traders backtest their strategies using historical data. This means you can:

- Test strategies over past market conditions.

- Identify which setups are consistently profitable.

- Adjust and refine your trading plan with real data-driven insights.

✅ Real-Time Trade Data & Risk Analysis

With real-time performance metrics, FXBullsheet helps traders manage risk more effectively, ensuring they stay on track with their goals.

✅ The Most Affordable Trading Journal Without Compromise

FXBullsheet offers all these powerful features at the lowest price in the market, without sacrificing functionality. Compared to FX Replay, TradeZella, and Edgewonk, which charge significantly more, FX Bullsheet provides the best value for serious traders who want top-tier journaling, analytics, and backtesting at an unbeatable price.

Conclusion: Upgrade Your Trading Journal Today

If you’ve struggled to maintain a consistent trading journal—or found that traditional methods lack the insights you need—it’s time to switch to FX Bullsheet. With advanced analytics, AI-powered trade optimization, and integrated backtesting, we make journaling effortless and effective—at a price no competitor can match.

👉 Ready to take your trading journal to the next level? Try FXBullsheet today!

No responses yet